Keep3rV1 (KP3R) Explained: The Role of Liquidity Providers

Keep3rV1 (KP3R) Explained: The Role of Liquidity Providers

What is Keep3rV1 (KP3R)?

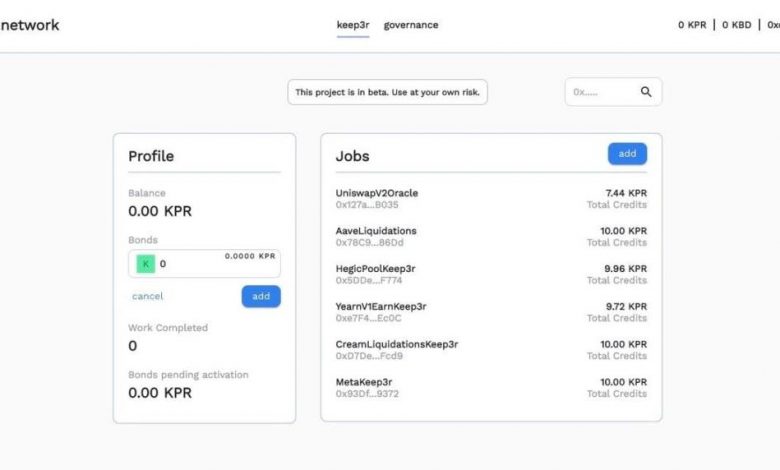

Keep3rV1 (KP3R) is a decentralized protocol built on the Ethereum blockchain that aims to bridge the gap between developers and external service providers. It functions as an intermediary layer, enabling developers to interact with external jobs by leveraging the power of liquidity providers.

The Role of Liquidity Providers

Liquidity providers play a crucial role in the Keep3rV1 network. They supply liquidity to the protocol by staking their tokens, allowing developers to access the required services for their applications. These services can include off-chain data, decentralized exchange (DEX) trades, or even computational power.

By becoming a liquidity provider in the Keep3rV1 network, users can earn rewards in the form of KP3R tokens. These tokens serve as the native currency within the protocol and can be used for governance and voting.

How to become a Liquidity Provider on Keep3rV1?

To become a liquidity provider on Keep3rV1, you will need to follow these steps:

1. Obtain the required assets: You will need to acquire the necessary tokens, such as KP3R and any other assets specified by the protocol.

2. Stake your tokens: Once you have the required tokens, you can stake them in the Keep3rV1 liquidity pool. This process usually involves interacting with smart contracts and following the instructions provided by the protocol.

3. Monitor and maintain liquidity: As a liquidity provider, it is important to monitor and maintain your liquidity in the pool. You may need to periodically add or remove liquidity based on market conditions or protocol requirements.

Frequently Asked Questions (FAQs)

1. What are the benefits of being a liquidity provider on Keep3rV1?

Becoming a liquidity provider on Keep3rV1 offers several benefits. These include earning rewards in the form of KP3R tokens, participating in governance decisions, and supporting decentralized applications by providing the necessary services.

2. How are rewards distributed to liquidity providers?

Rewards for liquidity providers on Keep3rV1 are distributed based on their proportional share of the total liquidity provided. The more liquidity you contribute, the higher your share and potential rewards.

3. Is there any risk involved in being a liquidity provider?

Yes, being a liquidity provider involves certain risks. These risks include impermanent loss, smart contract vulnerabilities, and market volatility. It is important to thoroughly understand these risks and conduct proper research before becoming a liquidity provider.

4. Can I withdraw my liquidity at any time?

Yes, in most cases, you can withdraw your liquidity from the Keep3rV1 liquidity pool at any time. However, some protocols may have specific lock-up periods or withdrawal fees, so it is essential to check the details before making any decisions.

Conclusion

Keep3rV1 (KP3R) provides a unique solution for developers to access external services through the support of liquidity providers. By becoming a liquidity provider, users can not only earn rewards but also contribute to the growth and development of the decentralized ecosystem. However, it is important to thoroughly understand the risks and conduct proper research before getting involved in liquidity provision on Keep3rV1.

Disclaimer: This article does not constitute financial advice. Users should do their own research and exercise caution when engaging in any investment activities.